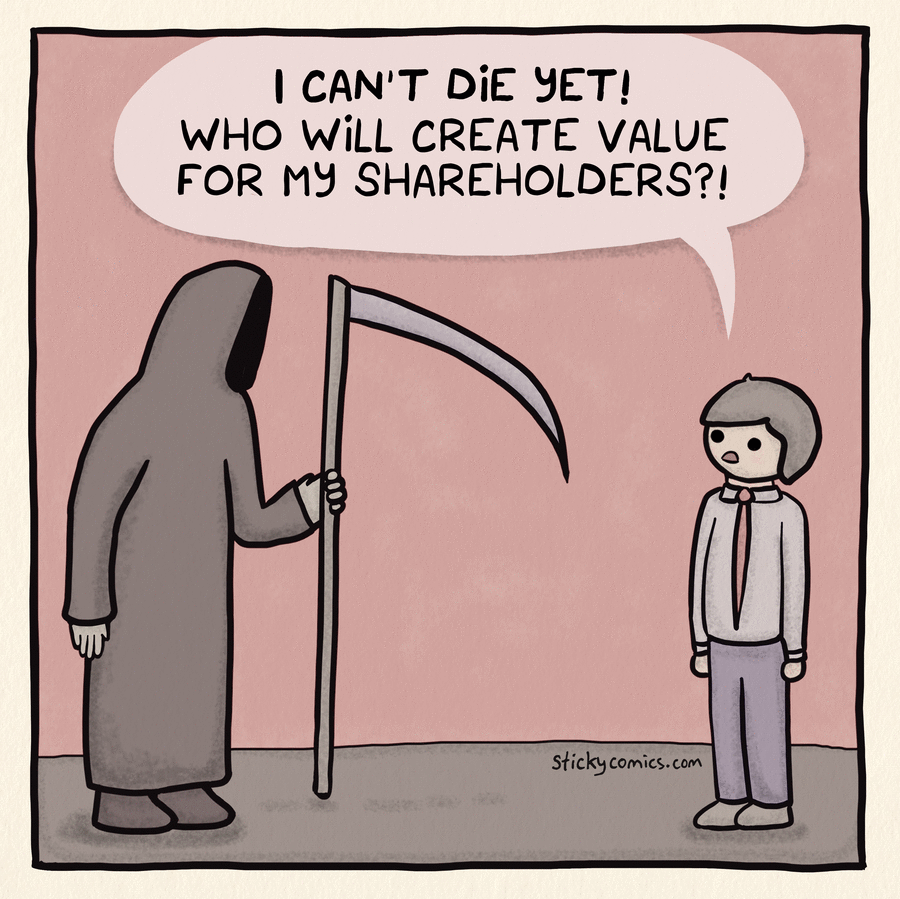

The most fulfilling economic system ever created!

Imagine if labour hired capital instead of the other way around.

It’s such a strange idea that we say money or capital goes to work when invested and that often that capital is valued more than human beings doing actual work. It seems very backwards.

There was a book called PostCapitalism that talked about when the returns of financials exceeds the returns on actual goods and services, there tends to be collapses and such. It’s been a while since I’ve read it. It didn’t really present a way out of capitalism beyond “I dunno, UBI maybe?” but the rest of it was interesting.

any money given to the middle and lower classes ends up in the pockets of the rich by the end of the day. UBI is literally just welfare for the rich.

The only way out is horizontal organising.

I would be happy for my shares to go to zero if it meant working didn’t feel like this.

In the meantime spend EVERY spare cent on dividend stocks and organise.

So many communists in my city do not and cannot understand your last sentence. They literally have zero retirement and investment plan. Just because it you don’t like capitalism doesn’t mean you can’t invest in your future. I was shocked!

I would be happy for my shares to go to zero if it meant working didn’t feel like this.

Same, I will happily see capitalism and thus my savings burn to the ground if it means establishing socialism, but if a (world) revolution will not happen, I don’t want to have to depend on German rent insurance and would like to not go into a broke retirement (which probably will be at the age of 70) lol

In the meantime spend EVERY spare cent on dividend stocks and organise.

imho the org(s) or party you are a part of should be allocated half of that (at least will in my case).

Before I go off about my current investments, I want to mention that once I am able (mentally and my life situation allows for it), I plan to get active politically and finally do some praxis. Along with that will go a split of my disposable income (ie. subtracting costs of living like rent, utils, basic foods etc.) as follows:- 50% to the org(s) and party I join (or help found)

- 50% for me (split is variable but more of a rule for myself)

- 50% of that goes to savings (including establishing/upkeeping a liquid reserve of a 3-6 month buffer)

- the other 50% of that are for leisure

(Now onto the investing stuff)

I would rather suggest a global ETF protolio since you don’t take unnecessary risks there and still get good returns.Both accumulating and distributing ones btw. Bc with the acc ones you get exponential growth over time and the distributing ones might make sense depending on your local tax policies (like some countries don’t require taxes for capital gains up until a certain amount. It would make sense to fully use that amount every year with distributing ETFs)

Personally I drive core/satellite (80/20) strategy for my long-term acc portfolio:

The core is made up of regional FTSE ETFs to cover the whole globe (regional for developed and the big emerging one). I weight them based on GDP and not market cap (the ETFs do go after market cap for each region tho, which makes a good balance) since that makes more sense imo. Same with putting only 30% in NA (partially bc I won’t solely bet on the US empire and partially bc I otherwise would overweigh them too much with my satellites).

(Now that the concrete mentions of specific ETFs begin, I should mention that I’m writing those from a German POV and they might not be the same in other region. Though the general concept is agnostic to specific ETFs)

Then there are 5 equally weighted satellites, which make up 20% of the long-term portfolio:

- FTSE Vietnam (since FTSE classifies them as a frontier and thus does not include them in their emerging markets indeces)

- iShares Automation & Robotics

- iShares Electric Mobility & Transportation (or smth like that)

- MSCI Global Semiconductors (takes everything sc-related from MSCI ACWI IMI, so TSMC is included for example)

- iShares Global Clean Energy (acc as all the other ones but my broker only recently made the acc version available)

Though a more simple 65 to 35 (or choose your weights), of FTSE Developed World and FTSE Emerging Markets would probably perform just as well and in current conditions does perform better (bc US is so high rn).

On another broker (which gives good interest on the cash you keep there, currently 3%), I implement the dividend portfolio, which is not as much about risk management and being invested in all markets, but rather fully using the yearly tax-free 1000€ (not there yet by a biiiig margin tho. Once I reach it to ~120% I will completely stop the actice savings plans):

- 40% Xtracker STOXX Select Dividend 100 (take the Xtracker instead of iShares, Xtracker one has a much higher dividend for whatever reason (it being swap instead of physical shouldn’t make that much of a difference))

- 40% FTSE Emerging Markets High-Dividend Low-Volatility

- 20% Global Dividend Aristocrats (as a more or less solid 3-4% return baseline)

And night after night

Only another 40 years of looking at the accidents that M$ calls “programmes”! wooo