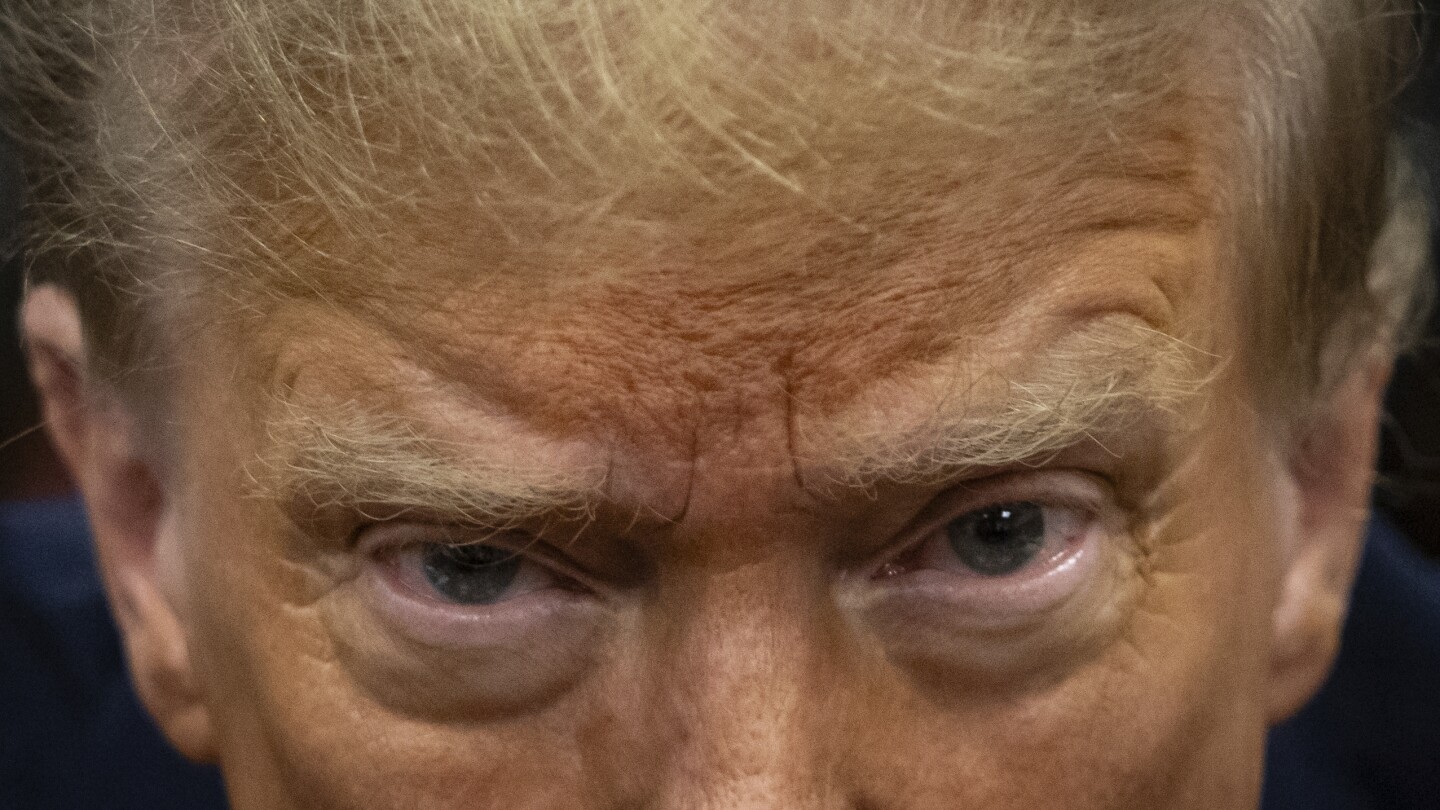

Rooting for Donald Trump to fail has rarely been this profitable.

Just ask a hardy band of mostly amateur Wall Street investors who have collectively made tens of millions of dollars over the past month by betting that the stock price of his social media business — Truth Social — will keep dropping despite massive buying by Trump loyalists and wild swings that often mirror the candidate’s latest polls, court trials and outbursts on Truth Social itself.

Several of these investors interviewed by The Associated Press say their bearish gambles using “put” options and other trading tools are driven less by their personal feelings about the former president (most don’t like him) than their faith in the woeful underlying financials of a company that made less money last year than the average Wendy’s hamburger franchise.

Obvious shorts can be dangerous because they can always be squeezed if too many people try to get in on it. Holding puts is much safer because your broker can force you to close a short position if it doesn’t like the risk involved in it (infinite downside potential). Holding a put has no risk (the only downside is the up front cost to buy the put, so you’re already in for that regardless of what the price does). But that said, you can still lose 100% of whatever you put into it easier than you’ll lose 100% of a stock investment.

That’s why I didn’t touch DJT or RDDT, despite being pretty confident that they will fail in the long run. Short and medium term prices are unpredictable and become more likely to go up the more people bet they’ll go down.